Bitcoin: Con, Currency, or Cure

Bitcoin…the asset that almost everyone’s paying attention to, yet almost nobody comprehends. The key to understanding bitcoin, according to Joe Weisenthal, executive editor at Bloomberg, is to think of it as a religion. In this creative article, he explains how bitcoin fits the definition of ‘religion’ by having prophets, sacred texts, special holidays, evangelism, false prophets, schisms, and, ultimately, a battle between good (believers) and evil (bankers).

Weisenthal’s idea is fascinating to me, so I’ll take it a step further. If bitcoin is indeed a religion, one framework to try to understand it could be Lewis’s Trilemma, popularized by C.S. Lewis, theologian, and author of the Chronicles of Narnia. The Trilemma posits three possibilities for the divinity of Jesus: Lunatic, Liar, or Lord. Jesus would only claim divinity if he were 1) well-intentioned with a screw loose, 2) purposefully deceiving, or 3) genuinely divine.

So, I present to you the Bitcoin Trilemma: Con, Currency, or Cure.

Con

John Oliver joked that bitcoin is “everything you don’t understand about money combined with everything you don’t understand about computers.” Maybe the best argument for bitcoin as a scam is its sheer complexity. A staple of the Warren Buffet investment process is that you should never invest in a business you cannot understand.

With its meteoric rise, bitcoin has minted countless millionaires whose explanation of bitcoin begins with a vague discussion of blockchain technology, weaves in a foreign language involving “satoshis” and “hashing,” and eventually concludes that bitcoin somehow solves all the problems caused by central banks. (No judgment. I haven’t seen a good, succinct explanation of bitcoin, and I definitely can’t produce one myself.)

The point is, if you don’t understand the reason an asset has gone up, how can you understand the risks that may cause it to crater?

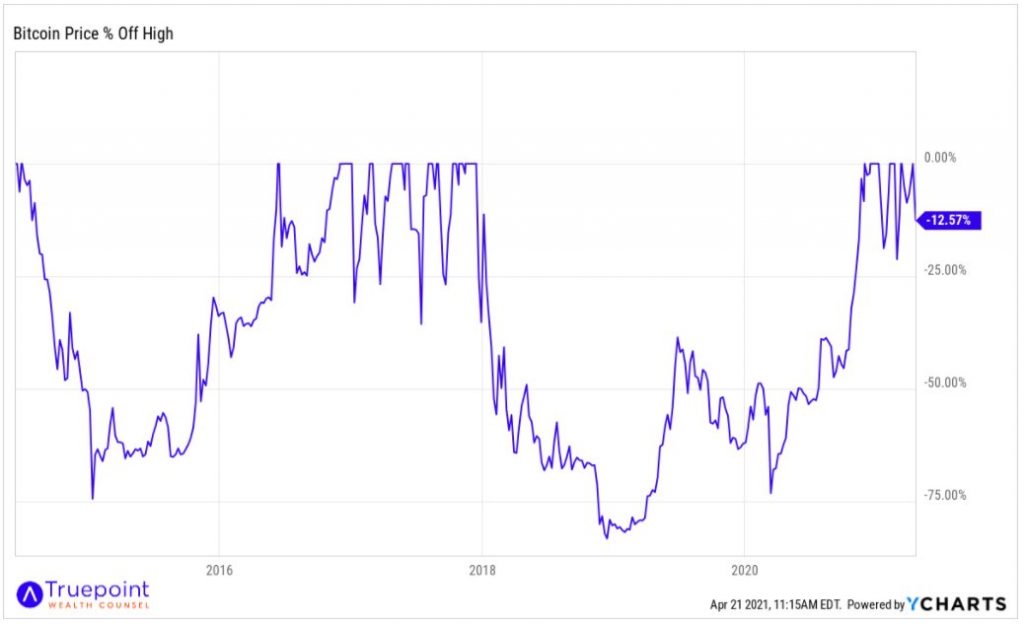

Two other possibilities, well-described in Bitcoin: Magic Internet Money by Alex Pickard, are that bitcoin is a massive, speculation-induced bubble, or worse, the price is being artificially manipulated higher by a select few individuals with the power to do so. Pickard was an early adopter of bitcoin in 2013; his article provides awesome insight into why he has turned bearish. My trouble with the “bitcoin is going to $0” crowd is this: it’s had plenty of opportunities to go away, and yet it’s still here. Over the last seven years, Bitcoin has been at least 50% below its high 57% of the time! It has endured eight separate crashes of more than 60%.

And yet, bitcoin has come back from each crash to reach new highs eventually. I don’t know what bitcoin is worth, but I think its resiliency means it’s probably worth something.

Currency

A significant use case for bitcoin is as a global digital currency. This application would be especially beneficial for developing countries plagued by corrupt governments, hyperinflated currencies, and limited access to financial systems. Why? Ideally, bitcoin offers a globally recognized store of value, free from any governmental control, with accurate fund traceability and immediate electronic payments.

The biggest problem with this theory goes back to the chart above. How can bitcoin, with its volatility, serve as a viable currency? Would you be willing to make or accept payment with bitcoin knowing that the value could be 30% higher or lower the next day?

Decentralization from any government sounds good until you realize that traditional currencies like the US dollar have value because of the government’s sponsorship. Without a significant backer whose best interest is in maintaining the currency’s stability, bitcoin will be subject to competing interests, with varying motivations for influencing its value.

Cure

Bitcoin’s most fervent believers have anointed bitcoin as an elixir for the world’s biggest problems. Remember the Winklevoss twins, the guys who allegedly invented Facebook before Mark Zuckerburg? With the following quote, count them among this group:

Bitcoin makes decentralization possible, which is to say its center of gravity is the empowerment of the individual. Its very nature takes control away from the few and gives it back to the many. Within this decade, Bitcoin’s blueprint and ethos will redesign the Internet, the financial system, and money in a way that fosters greater independence, choice, and opportunity for all. Just like the invention of the printing press, the personal computer, and the early Internet before it. And that’s a big deal.

They are hardly alone in their aspirations for bitcoin. While currently a minority, this group grows larger (and louder) every time the price of bitcoin reaches a new milestone. If bitcoin is a religion, these are the cultists.

So, how do I answer the Bitcoin Trilemma?

Truthfully, I’m sitting squarely on the fence. I suspect bitcoin will continue to survive, eliminating the “Con” perspective, but I don’t foresee it redesigning the world as we know it, eliminating “Cure.” The only thing I’m sure of is that I’ll continue to have an open mind on cryptocurrencies. The range of possible outcomes is too wide for anyone to be close-minded.

We, at Truepoint and Commas, are not currently adding bitcoin to your diversified portfolio. See our latest Truepoint Viewpoint for a detailed explanation of why. But if you find yourself enamored with bitcoin, I encourage you to do your research. Try to avoid confirmation bias and seek to understand the motivations behind the source of your research. And most of all, don’t let past returns blind you. The most prevalent disclosure in the industry, “Past performance is no indication of future returns,” is ubiquitous for a reason. The desire to chase maximum returns is natural but doesn’t usually end well.

Disclaimer: The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained in this commentary is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. All investments carry a certain risk, and there is no assurance that an investment will provide positive performance over any period of time. An investor may experience loss of principal. Investment decisions should always be made based on the investor’s specific financial needs and objectives, goals, time horizon, and risk tolerance. The asset classes and/or investment strategies described may not be suitable for all investors and investors should consult with an investment advisor to determine the appropriate investment strategy. All opinions and views constitute our judgments as of the date of writing and are subject to change at any time without notice.

Commas, through our parent Truepoint, Inc. is a fee-only Registered Investment Adviser (RIA). Registration as an adviser does not connote a specific level of skill or training. More detail, including forms ADV Part 2A & Form CRS filed with the SEC, can be found at usecommas.com. Neither the information nor any opinion expressed, is to be construed as personalized investment, tax, or legal advice. The accuracy and completeness of information presented from third-party sources cannot be guaranteed. Commas is a wholly owned subsidiary of Truepoint Inc.