Coronavirus Update 🦠 —Part II

In our last update, we provided a case for optimism. It wasn’t easy. In fact, it was hard to imagine anything positive at that point. When you’re in the eye of the storm, that’s when it’s most difficult to see a path out.

We certainly haven’t made it through the crisis. There’s still much that could go wrong. But, some uncertainty has faded and that’s worth celebrating. And, while it’s still too early to tell, there’s a decent chance we’ve already seen the bottom in the stock market.

But, how can that be? We’re just beginning to see the horrible economic data that’ll confirm we’ve entered a virus-induced recession. Repeat after me:

“The stock market is not the economy. And, the economy is not the stock market.”

This wouldn’t be the first time the market rallied in the face of bad economic data. In fact, the market tends to care more about future expectations than current results. And, it’s fair to say that our expectations about the future were pretty dark towards the end of March.

In that spirit, let’s highlight some positive developments over the past few weeks that will shine some light on this recent rally. We’ll do so in the format of the playbook we outlined last time.

Containing the Virus

Ready for some good news? We’re flattening the curve!

“Flattening the curve” is just that — reducing the height of the peak and pushing infections out into the future. We’re not stopping the virus, we’re delaying it. This is crucial because it prevents unnecessary death. Sudden spikes in hospitalization overwhelm our healthcare system and kill patients that would have otherwise survived. It also gives us crucial time to build-out testing (to further slow the virus) and develop a vaccine (eliminate it altogether).

We’re finally seeing the effects of social distancing in hospitalization data around the world. This chart shows the U.S. epicenter, New York. Over the past three days, we’ve actually seen a decrease in COVID-19 hospitalizations! The peak occurred in early April and has been trending lower since then.

At the same time, we’re seeing projections for peak hospitalization and ventilator demand decline across the board. Every time a model is updated, it seems to be a significant revision lower from previous projections. This is good news! But, why is it happening?

It’s a combination of a few things: 1) our dramatic response (social distancing, behavioral changes, etc.) is changing the transmission speed of the virus; 2) assumptions in the initial models might have been wrong!

Speed of the Virus

The first point is relatively easy to understand. We’d expect dramatic shutdowns to reduce the speed of transmission. R0 is the basic reproduction number of an epidemic. It’s defined as the number of secondary infections produced by a single infection. If R0 is greater than one, the epidemic spreads quickly. If it’s less than one, the epidemic spreads, but disappears before everyone is infected.

Since we’re not standing still while the virus sweeps the nation, the effective reproduction number (Rt) is much more important. It measures how fast the virus is spreading when considering the measures we’ve taken to slow it down. As you can see, Rt varies widely across the U.S. as each state has taken a different approach to combat the virus:

Infection Fatality Rate (IFR) vs. Case Fatality Rate (CFR)

The second point mentioned above is perhaps more controversial because it could be a dramatic, positive revelation in our fight against the virus.

A big assumption in these models is the size of the vulnerable population. Once a person has been infected with COVID-19, they’re immune. When enough people are immune (somewhere between 50% to 70% of the population), the virus won’t spread further. This is called “herd immunity.”

Many people who contract the virus are asymptomatic, meaning they have no observable symptoms. So, how do we know who’s been infected? Ideally, we’d test everyone. But, since testing capacity is limited right now, it’s hard (if not impossible) for an asymptomatic person to receive testing. Remember, a few weeks ago, it was hard to get tested even if you had the symptoms!

However, in some studies around the world, we’re sampling the broader population (“serological surveys”) with antibody tests to gain insight into just how far the virus has spread. The results are surprising both in terms of the overall infection rate and the proportion of infections that are asymptomatic:

- German Gangelt study(4/9/2020). 1,000 tested. 2% actively infected. 14% with antibodies, indicating prior infection.

- New York–Presbyterian Allen Hospital (4/4/2020). 215 pregnant women tested between March 22nd and April 4th. 15.4% positive for COVID-19. 1.9% exhibiting symptoms. 13.5% of positives were asymptomatic

- Boston homeless shelter (4/15/2020). 408 tested. 36% (176) positive for COVID-19. More than 90% of positive subjects asymptomatic

So, why does this matter? And, why would this be good news? The models we’re using have embedded assumptions about fatality and hospitalization rates. We’ve relied heavily upon a case fatality rate (CFR) in many of these models. The CFR is calculated by dividing the total number of deaths by the total number of diagnosed cases.

But, since we’re only testing those who have symptoms, we could be drastically underestimating the denominator in this equation. Stated another way, we may be drastically overestimating fatality and hospitalization rates if you take into account all the asymptomatic people who haven’t been diagnosed! There’s another methodology, an infection fatality rate (IFR), that calculates the rate based on the total number of people who have been infected, not just those that have been diagnosed. It’s a subtle difference, but can lead to much different results.

Unfortunately, we don’t have enough data for a reliable IFR. So, for better or worse, we’re relying upon CFR assumptions to make decisions. This may be part of the reason we continue to revise the models lower. How much of a difference could it make? The Centre for Evidence-Based Medicine (CEBM) at the University of Oxford currently estimates the CFR globally at 0.51%, while estimates for IFR range from 0.10% to 0.26%. This may not seem like much, but when used to model the effect on millions or billions of people, it produces drastically different results.

We’re using the best data we have and should expect the quality of our data to improve as more testing is carried out globally. If widespread testing reveals lower fatality or hospitalization rates, it could materially impact the policies currently being used to slow the virus.

Testing and Tracing

When we emerge from government mandated shutdowns, we’ll rapidly shift towards an environment of large-scale testing and tracing to prevent further spread of the virus. This is a surgical way to slow the virus versus the brute-force, quarantine method we’re seeing today.

We’ve made strides in increasing our testing capability to identify those that currently have the virus. A saliva test developed by Rutgers University received the FDA green light in the past few days. It’ll allow us to conserve precious PPE equipment that previously had to be worn during testing.

We’re also making strides in the serological testing capabilities mentioned above. This will help us determine who’s previously been exposed to the virus. The FDA recently granted Cellex an emergency use authorization (EUA) for a blood test that looks for antibodies to determine whether a person has previously been exposed.

The technology community is delivering unique solutions that will trace the reach of infected individuals. Apple and Google jointly debuted a contact tracing methodology whereby our smartphones exchange information in an effort to alert us if we’ve been exposed to someone who is later diagnosed.

This may seem creepy to you. But, we’ll all likely have to cede privacy for the greater good of society in the coming months ahead. If we don’t, we’ll need to remain in quarantine and brace for further economic pain. Remember when you used to be able to wear shoes during TSA screening? Yeah, me neither.

Treatment

As mentioned in our last post, the medical community continues to experiment and share best practices for patients requiring hospitalization. Since then, there are a number of treatments undergoing clinical trial:

“…closely related malaria drugs chloroquine and hydroxychloroquine; the antiviral medication remdesivir (originally developed to treat Ebola); the antiviral combination of lopinavir and ritonavir (used for HIV); and those two HIV drugs plus the anti-inflammatory small protein interferon beta”

“The U.S. Food and Drug Administration has approved remdesivir for treating COVID-19 patients under the compassionate-use protocol (a designation that gives patients with life-threatening illnesses access to an experimental drug). And the agency has granted an emergency use authorization — which allows for otherwise unapproved drugs or uses during an emergency — for chloroquine and hydroxychloroquine.

The verdict is still out on whether these treatments will pass the scrutiny of clinical trials. But, front-line defenders are finding some efficacy in these treatments as hospitals turn into war zones. Early results from remdesivir clinical trials are encouraging, potentially clearing the way for fast regulatory approval. If this happens, it could materially change the fatality rates of those patients that require hospitalization.

Vaccine

Bill Gates has achieved some notable things over his lifetime. Some might be satisfied with starting a personal computing revolution and eradicating polio. But now, the Bill and Melinda Gates Foundation is simultaneously funding factory construction for seven different vaccines, knowing that only one or two of them will ultimately work.

This strategy is guaranteed to result in the loss of a few billion dollars. They’re knowingly doing this to accelerate the timeline for a vaccine, scaling up manufacturing as the vaccine is being tested for safety and efficacy. Godspeed, Bill Gates. The world is counting on you (again).

The timeline below shows one possible path for a vaccine. It first becomes available to healthcare workers later this year, and then broadly available to the public by March of next year. We’ll have to see how it actually plays out.

Backstopping the Economy

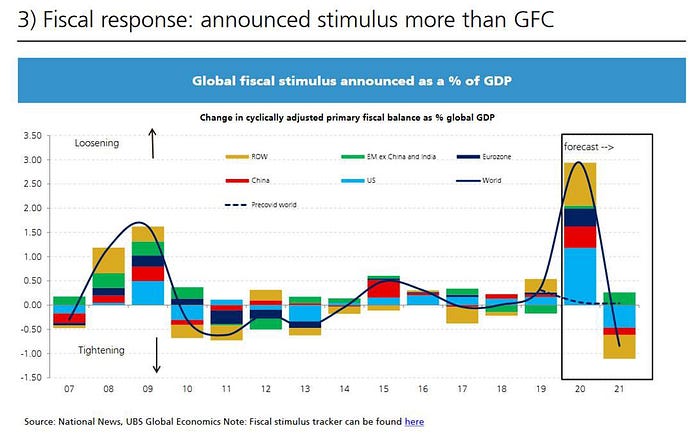

Governments around the world have delivered on their promise to backstop the economy. The fiscal response to this crisis has been larger and faster than the response to the Global Financial Crisis. If we were heading towards a virus-induced Depression, this is the economic equivalent of a vaccine.

Here’s a look at some of the provisions included in the historic $2 trillion CARES Act, signed into place a few days after our first blog post:

- Corporate aid ($500 billion)

- Loans to small businesses and payroll protection ($349 billion). Low-interest rate loans to small businesses with potential for forgiveness

- Direct payments to +80% of all taxpayers ($290 billion)

- Supplemental funding for unemployment insurance ($250 billion)

The Federal Reserve hasn’t been sitting on its hands either. In addition to the quantitative easing programs announced at the start of the crisis, it expanded its bond buying program to provide stability in the fixed income market during the final days of March.

The result was dramatic and brought immediate stability to a bond market that was showing signs of panic. The Fed later extended this program to include high-yield and municipal bonds, where it had a similar impact. These are textbook crisis maneuvers and the Fed is acting like a grizzled Global Financial Crisis veteran.

Finally, corporate America rallied to help without requiring government use of the Defense Production Act. GM and Ford are making ventilators, Brooks Brothers is producing masks, distilleries are producing hand sanitizer, and countless other examples. It’s shown us a glimpse of our productive capacity when we’re all united around a common goal.

What can we expect going forward?

A dramatic shift towards a testing-centric approach and really bad economic news (hopefully followed by really good economic news).

The U.S. government is making preparations to reopen the economy. Just this evening, they released a three-phase plan for reopening the country. Prior to this guidance, many states had banded together into regional entities to coordinate their own strategies. It’s clear that everyone has their eyes set on emerging from shutdown and doing so in a very controlled manner so that we don’t see another spike in COVID-19 infections.

This is really important because if we do see another spike in infections, the economy is likely to shut down again regardless of whether it’s mandated by the government. At least, that’s what happened in the days leading up to the official shutdowns in March. This incredible graphic from OpenTable shows reservations dropping precipitously before individual state shutdowns we’re announced. If people don’t feel safe, our ability to stimulate the economy is limited, which is why containing the virus has always been the first step in the playbook.

Record-high unemployment figures

Over the past few weeks, we’ve seen record jobless claims. Besides producing an eye-popping graph, it’s hard to fathom how 17 million people could lose their job in just three weeks?

Well, maybe they didn’t. Unemployment may be somewhat misleading in this crisis because it’s being used as a way to transmit fiscal stimulus. Unemployment programs were used to provide early assistance to small businesses at the start of this crisis before Congress could pass the CARES Act. When states implemented shutdowns, they created special policy to allow employees who were temporarily furloughed or laid off to become immediately eligible for unemployment benefits. This ensured employees would continue to be paid, but also was an immediate lifeline to affected businesses!

Stated another way, is it really “unemployment” if it’s not permanent? If those businesses intend to re-hire as soon as they’re allowed to open? It’s a temporary way to keep individuals and businesses afloat while we shut down their businesses. Once they’re allowed to reopen, we should see a drop in unemployment just as dramatic as the increase we’re seeing today.

The big question is how much damage has been done while these companies waited for government aid. Will they survive? And more importantly will they re-hire? Only time will tell.

Another question is whether we’ve done enough to backstop the economy such that job loss isn’t leaking into sectors outside retail and restaurants? The answer to that is most certainly “no.” Across the board, companies are pulling back spending. But, that confidence could reverse quickly if news of an effective treatment or economic stimulus takes hold.

It’s worth noting that we shouldn’t be surprised by the unique nature of this economic data. We’ve never seen a global recession caused by a self-induced quarantine. It shouldn’t follow the path of a typical recessions, because this is anything but typical.

Rollercoaster GDP

Similar to unemployment, we’re going to see some pretty wild swings in GDP.

We’ll experience a record-setting drop in GDP this quarter (it’s easy to set a record when we’ve never closed the economy before) and we’ll see what shape the recovery takes as we gradually reopen the country over the next few months. It’s anyone’s guess how sharp the pain will be in 2Q (April to June), but here are some pretty wild estimates.

For the full year, the International Monetary Fund is predicting global growth to decline by more than it did during the Global Financial Crisis. The silver lining is that growth is expected to return meaningfully in 2021.

We’ll see how the economic data plays out, but there’s hope that we’ll experience a dramatic recovery in economic activity. That’s at least what’s played out in China as they’ve reopened their economy.

This graphic shows The Purchasing Managers’ Index (a measure of economic trends in the manufacturing and service sectors) crashing and rebounding dramatically.

A couple of notes: 1) the decline was deeper than the Greater Financial Crisis, especially in the service sector; 2) the decline was short versus the long, drawn-out recovery in 2008. The decline and recovery occurred so quickly in China’s data that it almost looks like a data anomaly.

This is why there’s hope for a “V-shaped” recovery. The economy didn’t shut down because of a naturally slowing business cycle — it closed overnight with the flip of a switch. It will reopen with the same speed. We’ll just have to see how much damage has been done while the country was idle. If orders and backlogs haven’t been cancelled, we have a chance of emerging from this crisis quickly.

Other Factors that Could Surprise Us

This virus has illuminated many things for us. It’s shown us what’s important in life. Brought us closer to our neighbors. And united our country.

But, in the corporate world, it’s taken the digital training wheels off companies and pushed them down a very steep hill. Overnight, entire industries were forced to operate remotely. And, what likely was a surprise to many leaders, is just how well it works as a result of technology developed over the past decade. It’s something technology firms have known for years that sleepy industries just realized overnight. This may cushion the actual business disruption we see from shutdowns. In the 1918 pandemic, they couldn’t work. For many of us, it’s business as usual.

Another “adapt or die” moment hit the restaurant and retail industries during this crisis. If they didn’t have capabilities for online ordering, curbside pickup, or delivery through apps like DoorDash or UberEats, they do now. At the same time, consumers who’ve never used those channels are experiencing the ease and convenience of them for the first time. It’s driving adoption on both sides of the equation. Here are a few examples of companies rapidly changing their business model to deliver “relatively good” results in the face of a possible -100% overnight decrease in sales:

“We have retained approximately 70% of our sales compared to last year since moving to our enhanced curbside service model despite the fact that all our Domestic stores are closed to customer traffic and approximately 40 of them, particularly in the Northeast, have been completely closed to all business for at least 10 days at our discretion,” — Best Buy Business Update (4/15/2020)

Individual consumers are also stepping up to #buylocal and protect their local restaurants and retailers. Gift cards, generous tips, and GoFundMe campaigns are commonplace among many of our communities. Perhaps we’ll be surprised at the end of this crisis just how much this collective effort helped small businesses and employees alike.

That’s it for now! We’ll continue to provide updates as the crisis evolves. But, rest assured, there’s still many reasons to be optimistic as we navigate this crisis. Stay safe out there! 👊

Commas, through our parent Truepoint, Inc. is a fee-only Registered Investment Adviser (RIA). Registration as an adviser does not connote a specific level of skill or training. More detail, including forms ADV Part 2A & Form CRS filed with the SEC, can be found at usecommas.com. Neither the information nor any opinion expressed, is to be construed as personalized investment, tax, or legal advice. The accuracy and completeness of information presented from third-party sources cannot be guaranteed. Commas is a wholly-owned subsidiary of Truepoint Inc.