How to Maximize the Google 401(k) Plan

Navigating Google’s 401(k) plan can be daunting, especially with the diverse options and features available. In this blog post, we will explain the components of the Google 401(k) plan. Our guide offers clear, useful tips for any Google employee looking to improve their current plans.

Three key aspects of Google’s plan that make it stand out from others in the industry.

- Employer match program. Google will match 50% of your 401(k) contributions up to the pre-tax/Roth contribution limit. As of 2025, an employee can contribute up to $23,500 in pre-tax/Roth dollars. That means Google can add up to $11,750 in matching contributions to your account, if you contribute the maximum.

Even more notably, Google’s matching contributions vest immediately. In other words, you own 100% of the company’s contribution right away. This is true even if you leave the firm the day after the funds are deposited into your account.

- Wide selection of investment funds. As a Google employee, you can choose from a diverse set of funds, including over 30 investment options —from target-date to individual index to actively managed funds. This broad selection enables employees to choose the right mix of investment vehicles to meet their unique set of priorities and goals.

- Emphasis on flexibility. Google’s plan lets participants create their own tax strategy. They can contribute from pre-tax (Traditional), Roth, after-tax, bonus pre-tax, bonus Roth, and bonus after-tax dollars.

Three steps you can take today to maximize the Google 401(k) plan

As you consider how to tailor Google’s plan to meet your specific goals, here are three key actions you can implement.

- Maximize your pre-tax/Roth contribution limit of $23,500. Given the impressive employer match, focus on maximizing Google’s contribution to your 401(k) plan. The more you contribute, the more Google will contribute, and they will do so until you hit the $23,500 limit. That’s an extra $11,750 of Google’s money, and it vests to your retirement account immediately.

If you can contribute $23,500 from your salary to your 401(k), consider adjusting your deferrals today. Otherwise, you are leaving free money on the table.

- Take advantage of catch-up contributions. If you are 50 or older by the end of the year, you can contribute an extra $7,500 to your 401(k) in 2025. You can choose to make this contribution pre-tax or as a Roth contribution. Although these additional funds, commonly referred to as “catch-up contributions,” will not qualify for the employer match, they will help you save significantly more towards retirement.

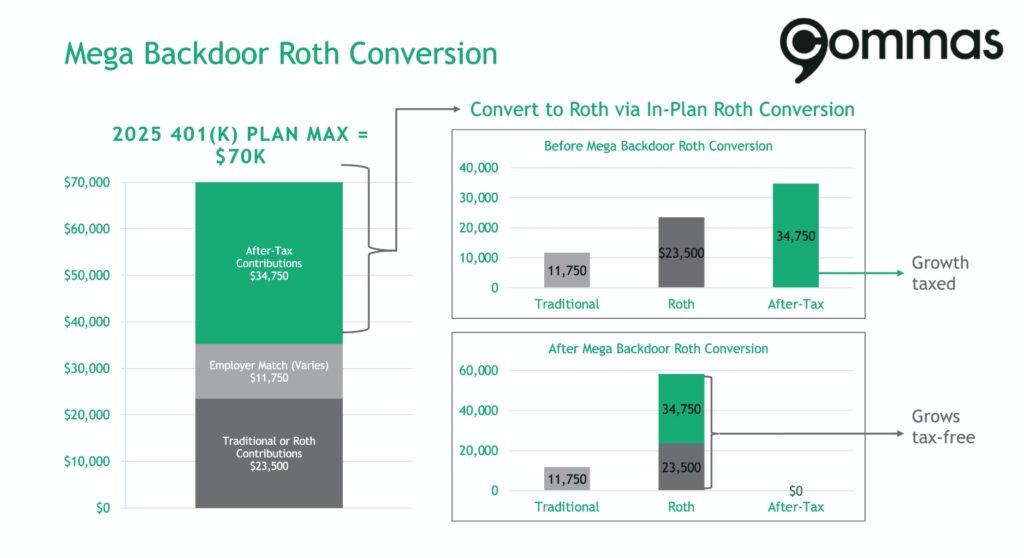

- Consider after-tax contributions, especially for the mega backdoor Roth strategy. We want to be sensitive around balancing shorter-term goals with the goal of retirement, but if your budget allows, you can contribute even more to your plan than the $23,500 limit mentioned earlier. This limit applies to pre-tax and Roth contributions only. You can also make after-tax contributions to your 401(k). As of 2025, your 401(k) account can receive as much as $70,000 in contributions each year. This includes all the money deposited into the account—both from you and your employer.

For example, an employee contributes the maximum amount of pre-tax/Roth dollars ($23,500). Google matches 50% of that, which equals $11,750. In total, those contributions add up to $35,250—far short of the $70,000 limit. Therefore, this employee could still contribute another $34,750 in after-tax contributions to their 401(k) account.

Google also allows for in-plan Roth conversions, which completes the mega backdoor Roth strategy. You can learn more about the mega backdoor Roth strategy here.

Analysis paralysis: the biggest threat to your retirement plan

A highly flexible retirement plan like Google’s can provide enormous benefits but can also feel overwhelming. Probably the most common way people learn valuable “hacks” about their employer’s plan is through their coworkers. But those coworkers aren’t privy to the whole picture.

Consider the range of personal and professional questions you might be facing:

- How do you balance saving for shorter-term goals (wedding, kids, house, etc.) with making sure you are on track for retirement?

- How should your 401(k) be invested?

- Should you be making pre-tax or Roth contributions?

- Does maxing out after-tax contributions make more sense through your paychecks or using your annual bonus? How does this impact cash flow?

- Should you prioritize debt or your 401(k)?

- What should you do with your old 401(k) plans?

Your answers to these questions should directly inform your planning decisions. And they should make you cautious about simply opting for the plan’s default options—or taking the same approach as your colleagues.

Commas’ in-depth knowledge of Google’s retirement plan combined with our financial expertise and extensive array of quantitative tools, can help simplify, streamline, and maximize your specific retirement plan. We are here to help you navigate the complex, inter-related set of decisions that constitute retirement planning.

Commas is a wholly-owned subsidiary of Truepoint Inc., a fee-only Registered Investment Adviser (RIA). Registration as an adviser does not connote a specific level of skill or training nor an endorsement by the SEC. More detail, including forms ADV Part 2A and Form CRS filed with the SEC, can be found at www.usecommas.com. Neither the information, nor any opinion expressed, is to be construed as personalized investment, tax or legal advice. The accuracy and completeness of information presented from third-party sources cannot be guaranteed.