GameStop: An Appreciation for the Greatest Story in Finance

Many retailers are struggling during this pandemic. Especially retailers that primarily exist in malls and have no significant online presence. Retailers in malls, without an online presence, operating in an industry where hardware is increasingly irrelevant, are almost hopeless.

Except for GameStop.

As of this writing, GameStop, the video game disc-selling business teetering on bankruptcy, is valued higher than Kroger, the world’s largest grocery store chain. By the time this is published, a $200 move in the stock price — in either direction — would not be surprising. (Update: within the next 2 hours, GME dropped 75% then gained 150%!

There are some excellent explanations on what is happening and how, click here for the best one I’ve seen. There are also some hilarious ones. I’m not going to dive into the technical details of short squeezes and gamma hedges in this post, but if you’re interested, feel free to reach out and I’ll do my best to explain in a jargon-free way. This post also doesn’t include prognostication about how this story may end (though I’m envisioning a “last one out has to turn off the lights and lock up” situation).

This is simply an appreciation post for the most fascinating story I’ve ever seen in finance.

For a brief moment in 2008, Volkswagen became the largest company in the world. I don’t remember this personally, but I imagine this was fun and shocking at the time. It was caused by some of the same technical aspects at work with GameStop now, but ultimately it was a fluke. It only lasted about a day and there wasn’t a larger story behind it.

This is different.

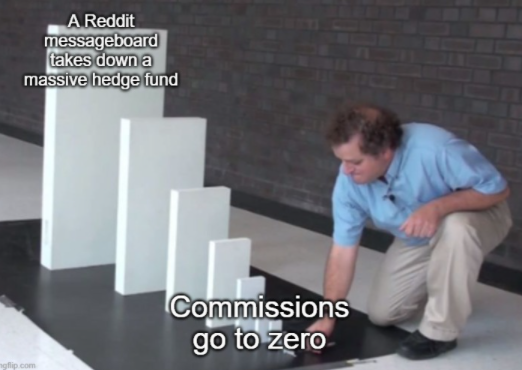

It started in 2019 when trading commissions at most brokerages went to $0.

It continued when the pandemic shut down most in-person activities.

Stimulus checks added fuel to the fire.

Engaging in online chat forums, discussing stock picks, and fervently celebrating “tendies” (winning trades, which you can spend on chicken tenders, the sacred meal for these Redditors) and losses alike became a new social activity to fill a pandemic-induced void.

Every story needs a good main character. “Roaring Kitty” is the perfect one for GameStop’s absurd story.

Every movement needs a cause. In this movement, it’s about more than money.

The classic Warren Buffet quote comes to mind: “In the short run, the market is like a voting machine — tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine — assessing the substance of a company.”

The current price movement reflects the forces of supply and demand at work. Lots of passionate traders converged on a relatively small and obscure company that was heavily shorted and used options to push up the price. It cannot last forever. GameStop will eventually fall back to reality. But some of the best stories make you question reality until the very end. Instead of trying to predict the end, can we just enjoy this unprecedented story as it unfolds?

Commas, through our parent Truepoint, Inc. is a fee-only Registered Investment Adviser (RIA). Registration as an adviser does not connote a specific level of skill or training. More detail, including forms ADV Part 2A & Form CRS filed with the SEC, can be found at usecommas.com. Neither the information nor any opinion expressed, is to be construed as personalized investment, tax, or legal advice. The accuracy and completeness of information presented from third-party sources cannot be guaranteed. Commas is a wholly-owned subsidiary of Truepoint Inc.